+27 86 111 6855 / info@portofgauteng.co.za

Recommendations

> Direct cross-subsidies to Transnet Rail Infrastructure Manager (TRIM) by N3 Toll to strengthen and expand the rail network, with the goal of scaling the Corridor to two lines in each direction to meet future demand.

> Reform the N3TC into a hybrid cost recovery and demand management model.

> Require PBS trucks to operate under abnormal permits from the Port of Durban to Port of Gauteng.

> Empower the Transport Economic Regulator to oversee tolls, cross-subsidies, and road– rail balance.

> Unscrupulous truck operators on the N3 corridor are flouting regulations and undercutting tariffs, undermining compliant operators and endangering road safety. Law enforcement must be strengthened to ensure full compliance.

> Implement seasonal toll adjustments to ensure tourism and road safety are protected during peak travel periods.

See the full vision: timelines, threats, and the inland port that could transform South Africa.

Introduction

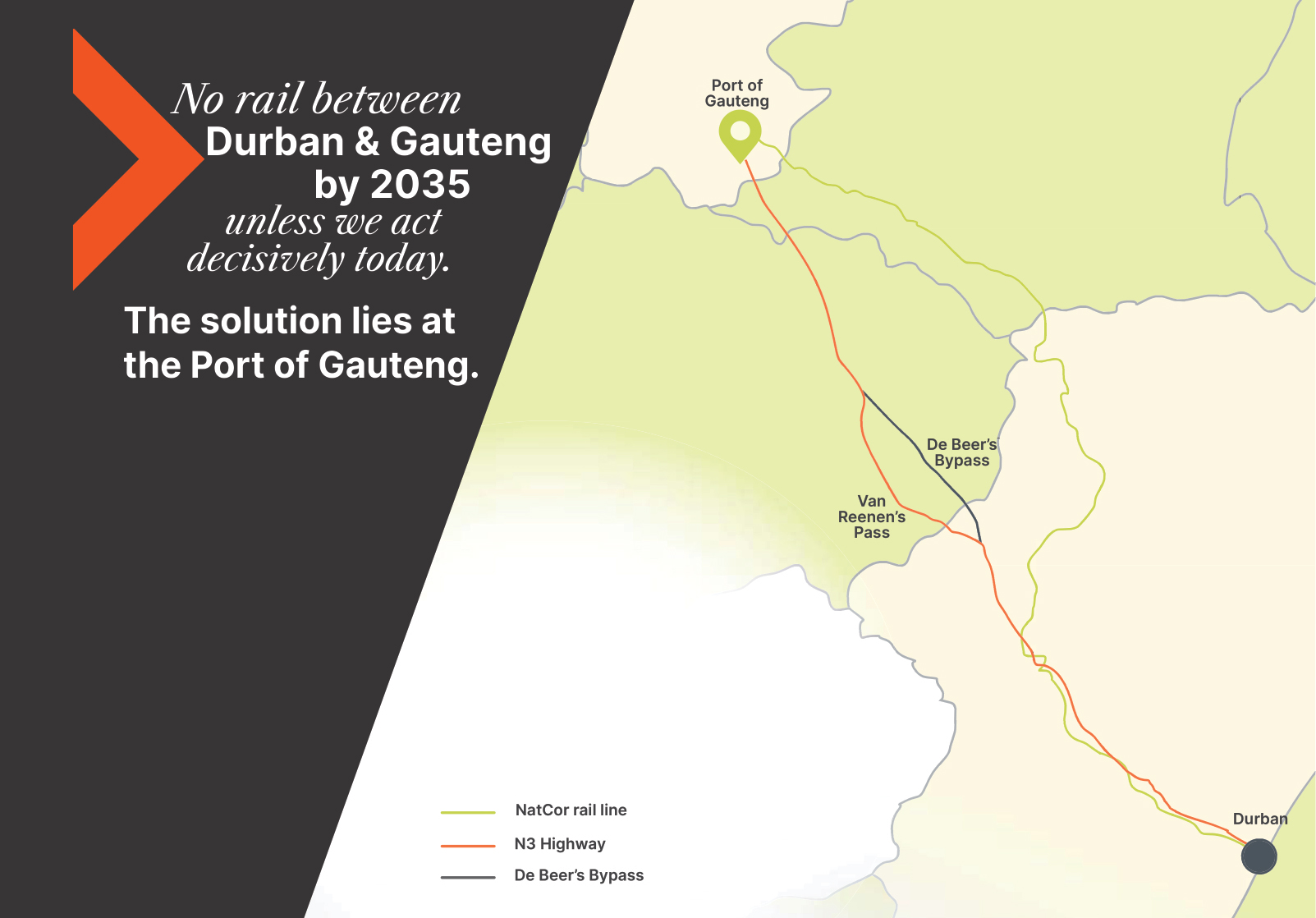

South Africa’s freight transport system is at a pivotal moment. The Durban–Gauteng Freight Corridor, recognised in the National Development Plan (2030) as the country’s most strategic freight route, is under severe strain. Improving the Corridor’s infrastructure and reducing transport costs is critical for economic growth and to handle the builk of the container volumes at Port of Durban.

Freight container volumes at Port of Durban are projected to grow from 2.8 million in 2024 to 20 million containers per year according to the National Development Plan (NDP)(equivalent 6m container a 12m container is counted as 2x6m containers). Transnet revised this estimate to 11.2 million containers per year. Given these projections, the current N3 and Durban–Gauteng rail infrastructure (now called the Container Corridor rail line) will not meet future demand. Unless the NDP’s commitments are implemented by 2030, congestion, inefficiency, and escalating costs will undermine South Africa’s competitiveness.

This White Paper evaluates the challenges facing the Durban-Gauteng Freight Corridor, sets out the problem in detail, and presents three strategic policy options for government consideration. It concludes with a clear recommendation that integrates rail and road freight in a way that ensures sustainability and secures long-term economic growth. With proper planning, investment, and use of infrastructure, the Freight Corridor can become a driver of national economic growth and job creation.

Problem Statement

The National Imperative

The NDP 2030 prioritises the Durban–Gauteng Freight Corridor, envisioning it as a model for how to strengthen and optimise freight corridors, calling for improved capacity, efficiency and sustainability. Yet, with only four years left until 2030, high transport costs and poor freight transport infrastructure are preventing the country from meeting its targets.

To succeed, South Africa requires:

• A shift from road to rail to meet the envisioned 50% split between road and rail on the Durban-Gauteng Freight Corridor by:

> Addressing rail’s lack of intermodal flexibility.

> Reducing truck traffic on the N3 by roughly one-third (volumes undisclosed by N3TC/SANRAL).

• Cutting logistics costs without unsustainable government subsidies for rail.

Historical Context

• 48 trains a day ran through Port of Gauteng’s section of the line during the 1980s, operating at full capacity.

• South of Port of Gauteng, from Glenroy station towards Durban, the line is double-tracked with capacity for 94 trains per day; in practice, up to 80 trains ran on sections of this line.

• This line, known then as the NatCor Corridor, now the Container Corridor, once underpinned South Africa’s freight logistics.

Why Rail Lost Market Share

• By truck, travel time from Port of Durban to Port of Gauteng is 8 hours. The N3 highway was modernised resulting in

a straighter, shorter (550 km vs 635 km, when the N3 construction started in 1960) – and faster route.

• By rail, travel time for the 690 km from Port of Durban to Port of Gauteng is 21 hours on a narrow-gauge line with steep gradients. Travel time to City Deep is increased to 24 hours as freight is delayed by PRASA’s passenger network.

As a result

• By 2012, rail volumes through Port of Gauteng dropped to 27 trains per day (40–45 between Glenroy and Durban).

• Transnet’s market share of Durban–Gauteng container traffic fell to 27% in 2012, collapsing further by 2014 as trucking firms unpacked containers in Durban to avoid costly empty returns.

• Despite drastic rate cuts, rail has never recovered above 16% market share since.

Mounting Losses and Decline

• Between 2014 and 2019, Transnet lost approximately R1 billion per year on the Corridor.

• During COVID-19, volumes dropped to just 10 trains a day from 80 a day, while cable theft surged, pushing losses to R3 billion annually.

• A World Bank study on the Corridor was commissioned but never published.

• By 2023–2024, volumes rose modestly to 15 trains per day between Glenroy and Durban – still far below historic levels.

Mounting Losses and Decline

• Between 2014 and 2019, Transnet lost approximately R1 billion per year on the Corridor.

• During COVID-19, volumes dropped to just 10 trains a day from 80 a day, while cable theft surged, pushing losses to R3 billion annually.

• A World Bank study on the Corridor was commissioned but never published.

• By 2023–2024, volumes rose modestly to 15 trains per day between Glenroy and Durban – still far below historic levels.

Contextual Considerations

Despite recognition of the Durban–Gauteng Freight Corridor as a national imperative, South Africa has not shifted any container cargo from road to rail; in fact, the opposite has occurred, with more cargo moving via road. The result is a freight system that is costly, congested, inefficient and unsustainable.

Since Rail moves less than 14% of Corridor volumes, it is far below the NDP’s 50% target. Currently, just eight container trains per day (four each way) move only ~100 containers each.

Container trucks on the Freight Corridor are inefficiently utilised. Approximately 85% of containers entering South Africa via ship are 12-metre units, while the remaining 15% are 6-metre containers. The maximum length for trucks operating on the N3 is 22 metres. Beyond this, they are regarded as abnormal trucks. The standard trucks are capable of carrying one 12m and one 6m container. However, because 12m containers dominate, there are not enough 6m containers to balance loads. As a result, most 12m containers are carried on 17m trucks, which increases costs per trip and adds to congestion and inefficient use of the infrastructure.

PBS (Performance-Based Standards) vehicles are poised to become more common in South Africa. These trucks, up to 30m in length, can carry two 12m containers, improving capacity and efficiency dramatically. By allowing PBS trucks strategically, South Africa could lower logistics costs, reduce emissions, and improve safety. (Refer to CSIR PBS Research (2023).

The N3 Toll Concession (N3TC) complicates the cost structure of the Freight Corridor. When the concession was granted in 1999, projections of truck traffic were far lower than actual volumes today. The concessionaire now collects significantly higher revenues from the unexpected growth in freight trucks – yet refuses transparency in its accounts. In 2029, when the concession should revert to a cost recovery model, tolls are expected to drop significantly, altering freight economics. N3 congestion is severe, exacerbated by R28 billion of ongoing roadworks and the Van Reenen’s Pass bottleneck. Medium-term solutions such as the De Beer’s Bypass may provide relief, but will not resolve systemic inefficiencies.

Tourism adds further pressure: KwaZulu-Natal relies on the N3 for holiday traffic from Gauteng. Freight dominance results in gridlock during peak travel, harming both tourism and road safety. Restrictions on heavy trucks during peak periods – except for vehicles carrying essential goods – are imperative.

Environmental and social costs continue to rise: more trucks mean faster road wear, higher accident rates, and greater emissions. Without intervention, these impacts will worsen as container volumes climb.

Finally, it must be recognised that the Durban–Gauteng Container Corridor carries high-value, time-sensitive goods, such as automotive, its components, retail products, and agricultural exports. Unlike bulk minerals, these require fast, reliable transport, meaning inefficiencies in this Corridor have an outsized impact on South Africa’s trade competitiveness.

The South African economy is shifting toward a model of high volume and low profit margins. This is clearly shown by the entry of major e-commerce players like Shein, Temu, and Amazon, and by the change in car sales: people are now buying more double-cab bakkies and Asian brands instead of luxury cars like Mercedes and Audis, choosing utility over traditional status.

Crucially, Shein, Temu, and Amazon currently fly most of their sales into South Africa; as their volumes scale, they will increasingly switch to container shipping, meaning that new traffic will move up the Durban-Gauteng Freight Corridor. This will place additional strain on the Corridor.

While private sector participation would reduce losses, the reliance on government support would grow as PBS trucks expand their market share and benefit from lower tolls under a cost recovery model. This option would delay the De Beer’s Bypass by approximately 10–20 years, depending on the economic and volume growth, and provide a short-term reprieve for Van Reenen’s and Harrismith. However, it does not resolve structural inefficiencies. Ultimately, rail would remain dependent on continuous government bailouts, diverting funds from other critical infrastructure and services.

Strategic Options

Option 1: Market Forces and Technology Alone

This option allows PBS trucks to operate freely on the N3 and other national routes, while converting N3 tolling to a pure cost recovery model after 2029 (this is the end of the N3 toll concession). Trucking costs would drop significantly, with marginal reductions in truck volumes compared to the current trajectory. In the short term, this could ease logistics costs for businesses.

However, the long-term risks are severe. Rail between Durban and Gauteng would collapse entirely, leaving the N3 as the only option for freight on this Corridor. The N3 highway would need to be expanded to four lanes in each direction to cope with projected volumes, particularly as container throughput at Port of Durban grows annually toward 11.2 million TEUs.

KwaZulu-Natal’s tourism sector would be severely affected, with road congestion forcing Gauteng residents to fly rather than drive for leisure trips. External costs such as road maintenance, emissions, and congestion would escalate significantly.

If this option is elected, then the De Beer’s Bypass would be required, depending on economic and volume growth, within 5–10 years. This would provide Harrismith with a temporary reprieve, but would not fundamentally address the long-term inefficiencies.

Option 2: Market Forces + Government Rail Subsidies

In this scenario, PBS trucks are allowed and N3 tolls are reduced as in Option 1, but the government intervenes to keep rail alive through subsidies. The Durban–Gauteng Freight Corridor rail line (known as the Container Corridor) currently loses around R2 billion annually. Introducing subsidies would preserve some rail services but at enormous fiscal cost.

Option 3: Balanced Integration of PBS Trucks and Rail (Recommended)

Option 3 proposes a managed balance between PBS trucks and rail, anchored by Port of Gauteng as an inland hub – with its future 3-hour turnaround times at the car and rail terminals in its superior location. The facility will have world-class car and rail terminals, featuring intelligent design and direct train- to-truck transfers to enable rapid, high-volume throughput. Under this model, PBS trucks would be allowed on the Port of Durban – Port of Gauteng route. They would be classified as abnormal loads, requiring permits for specific routes, ensuring that their efficiency gains do not undermine rail entirely.

Tolls for PBS trucks would be increased to offset some of their cost advantage. Permit requirements would also prevent them from diverting onto secondary roads such as the R103, which would ensure that they pay tolls. Reform of the N3TC would convert the concession into a hybrid model combining cost recovery with demand management, moving away from the current profit-driven model. Revenue collected from tolls

would be used to cross-subsidise the rail Corridor, ensuring its viability without large direct fiscal subsidies.

The planned Transport Economic Regulator would oversee toll structures and ensure balanced utilisation of both road and rail. Additionally, during peak holiday periods such as Easter Monday and 16 December, truck tolls could be raised by up to 1000% to prioritise tourism traffic and protect road safety. This seasonal demand management tool would ensure that freight and tourism can coexist without conflict.

Option 3 achieves the three critical goals of the Problem Statement: It addresses rail’s lack of intermodal flexibility, reduces truck traffic on the N3 by roughly one-third, and cuts logistics costs without unsustainable subsidies for rail.

Conclusion

The Durban–Gauteng Freight Corridor is South Africa’s most strategic freight route, but its sustainability is at risk. Without decisive action, the current inefficiency, congestion, and rail decline will erode competitiveness and undermine national development objectives, stifling economic growth.

Option 3 offers a pragmatic balance: efficient PBS trucking integrated with rail, supported by the inland Port of Gauteng as a logistics hub. This approach protects the rail system, reduces costs, and creates a resilient Freight Corridor capable of meeting the projected growth in container volumes. By adopting this model, South Africa can deliver on the NDP 2030 commitments and secure the long-term prosperity of its economy.

Contact Us

Secure your stake in the logistics asset of tomorrow. When location is everything, can you afford not to be here?